A good listing is like the front door of a house. It can look great from the curb, but you still need to check the foundation before you fall in love.

That’s the mindset to bring to business for sale listings, where the Asking Price and Gross Revenue are usually the most visible figures in any advertisement. While a Business Broker prepares these profiles to attract interest, the buyer must look deeper into cash flow and red flags. Whether you’re scanning a Business For Sale in Savannah, comparing Businesses for Sale in Atlanta, or chasing a cash-flow deal near Brunswick, the listing is only the start. The real skill is knowing what the numbers mean, what’s missing, and what questions to ask next.

Below is the same framework our broker team uses with buyers across Georgia and South Carolina, from Pooler to Macon, Warner Robbins, Dublin, Waycross, and up toward Hilton Head.

Start with cash flow, not the asking price

If you only read one line in a listing, read the cash flow line, and then read it again. Start your analysis of financial statements with cash flow, ignoring the asking price until you understand the earnings picture.

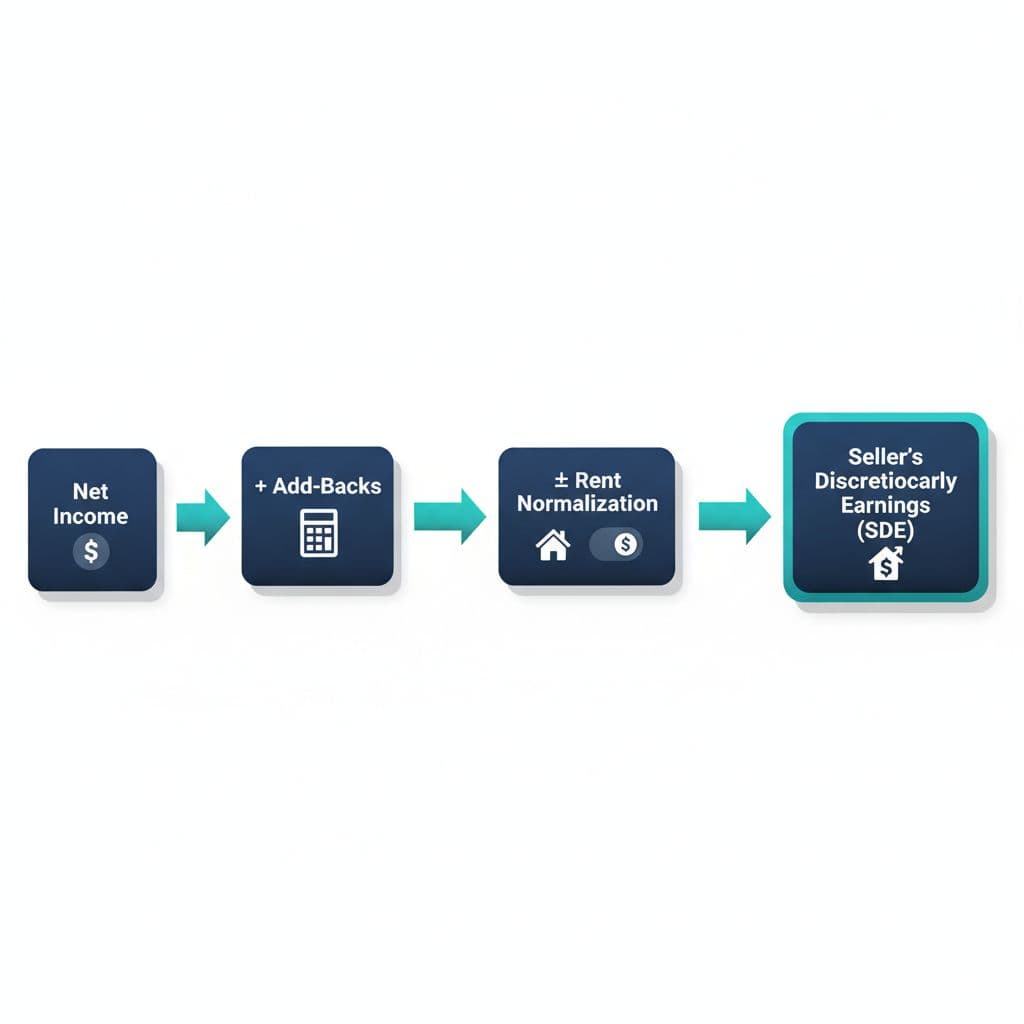

Most listings will describe cash flow using Seller’s Discretionary Earnings (SDE) (common for owner-operator businesses) or EBITDA (more common for larger companies with management in place). These metrics are typically derived from profit and loss statements and tax returns. If SDE is new to you, it’s worth getting the definition straight from an industry reference like BizBuySell’s SDE overview.

Here’s how we explain it in plain terms: SDE is the income the business produces for one full-time owner, before paying that owner’s personal “extras,” and before non-cash accounting items.

Pro way to read the cash flow section:

- Look for whether the cash flow is based on tax returns, internal statements, or “seller provided” numbers.

- Ask what time period it covers (last year, trailing 12 months, or a multi-year average).

- Check whether payroll includes a working owner doing the day-to-day, or a manager running the show.

- Evaluate owner involvement and its effect on net profit, especially in businesses with high gross revenue from personal relationships.

Example mindset from our current listings

When you see a listing like a Specialty Bakery in Savannah or an Established Carpet Cleaning Business, your first question shouldn’t be “What’s the valuation multiple or SDE multiple?” It should be, “How dependent is this cash flow on the current owner’s schedule, relationships, and skill set?” Valuation multiples and SDE multiples help justify the asking price relative to earnings, but a bakery with steady wholesale accounts and strong cash flow reads very differently than a service business where the owner is the lead technician.

If you want to compare multiple opportunities side-by-side, start with a clean view of what’s on the market and then narrow down. A good place to begin is Browse current business listings on B3.

Add-backs: where deals get won (or get ugly)

Add-backs are crucial adjustments for reaching Normalized Earnings, where a seller claims certain expenses a buyer won’t have and adds them back to show higher cash flow. Some Add-backs are perfectly reasonable. Others are wishful thinking with a spreadsheet.

Our broker team uses a simple rule: every add-back needs a story and proof. During the review of Financial Statements, if it’s real, it will show up in bank statements, payroll reports, insurance bills, or a clear one-time invoice. If it can’t be verified, it doesn’t belong in the valuation.

For a deeper look at how add-backs get inflated, see DealStream’s guide to understanding add-backs.

A quick “SDE bridge” example (simplified)

| Line item | Amount |

|---|---|

| Net income (per statements) | $120,000 |

| + Owner’s discretionary expenses | $40,000 |

| + One-time repair | $15,000 |

| ± Rent normalization | -$25,000 |

| Estimated SDE | $150,000 |

That rent line is where a lot of buyers get surprised, especially in fast-growing corridors like Pooler and parts of Savannah where lease rates can move quickly.

Rent, leases, and the CRE reality check

A business can be great, but a bad lease can choke it.

When a listing involves a lease, we push buyers to read the Lease Terms like a hawk: base rent, CAM charges, term remaining, renewal options, and whether there’s a personal guarantee. Listings don’t always spell out the full Lease Terms upfront, so you’re often reading between the lines.

This is also where the business side meets CRE. Many buyers start out looking for a business, then realize they’re also evaluating Commercial Real Estate for Lease terms, or sometimes even CRE for Lease plus equipment and goodwill. While most small business valuations use an Income-Based Approach, a Market-Based Approach or Asset-Based Approach might be relevant if significant real estate or equipment is included.

And in some transactions, the property is part of the deal. That’s a different animal, closer to Commercial Real Estate for sale, where the building’s condition, zoning, and tenant profile matter just as much as the business financials.

Due Diligence Red Flags in Business and Rent Listings That Don’t Show in the Headline

A listing is marketing, even the honest ones. The reason for selling is a critical detail not always in the headline, and true red flags often surface only during due diligence. So when we review Businesses for Sale with buyers, we look for what the listing doesn’t celebrate.

Here are the red flags we see most often, whether you’re shopping in Atlanta, Brunswick, Macon, Dublin, Waycross, or the Warner Robins area:

- Owner Involvement: If the owner is the sales engine, the lead tech, and the bookkeeper, your “cash flow” might actually be three jobs. Transition support from the seller can mitigate these owner involvement risks.

- Short lease term left: If there are only 12 to 24 months remaining, your lender may worry, and you should too.

- Unverified add-backs: If add-backs are described as “approximate,” expect the cash flow to shrink in due diligence.

- Customer Concentration: One client can be a blessing, until they’re a bully. You want to know the top 5 customers and what happens if one leaves.

- Lack of Standard Operating Procedures (SOPs): Without documented standard operating procedures (SOPs), operations can falter after transition.

Examples from our listings, and what we’d ask next

- A franchise-style opportunity in Brunswick (like a well-established fast-casual concept) might have strong systems, but we’d still confirm lease terms and any required remodels or brand upgrades. Those costs hit your real cash flow, alongside evaluating growth potential and market position.

- A long-running Savannah retail opportunity with more than one income stream can be exciting, but we’d test transferability: Which revenue lines rely on the owner’s relationships, and which are truly “turnkey”? We’d also review inventory and working capital to gauge final value. Here’s a good example of the kind of detail buyers should request early: Turnkey Savannah business with two income streams.

- Service businesses (carpet cleaning, rug cleaning, contractor services) often look great on paper, but we’ll dig into dispatching, reviews, staffing, and whether the seller is the key estimator. That’s where value can hide, or disappear.

If you want a wider buyer-side checklist before you spend money on attorneys and inspections, keep this bookmarked: Guide to buying a business with B3. It lines up well with how we approach early-stage screening and due diligence.

Conclusion: read listings like a buyer, not a browser

How to Read a Business-for-Sale Listing Like a Pro is simple: treat the listing as a lead, not a verdict. Start with cash flow, pressure-test add-backs, normalize rent, and don’t ignore the parts that feel inconvenient.

If you’re looking at a Business For Sale in Savannah today, then comparing it to Businesses for Sale in Atlanta tomorrow, consistency is your advantage. Ask the same questions every time, and the right deal starts to stand out.

When you’re ready, bring a listing you’re considering and let a Business Broker assist with Due Diligence to verify Financial Statements and Gross Revenue. A little homework now saves a lot of heartburn later, and a disciplined approach ensures your cash flow is protected along with your future.

We are Members of the Georgia Association of Business Brokers and Realtors, Commercial Alliance, Georgia Association of Realtors, National Association of Realtors, and the Savannah Area Chamber of Commerce